Of course! The term "multi-period" in Python refers to handling data or logic that evolves over time. This is a fundamental concept in many fields, especially in finance, economics, and operations research.

The core idea is to model a system that transitions from one state to another over a sequence of discrete time periods (e.g., days, months, years).

Let's break this down with a clear definition, common use cases, and detailed Python code examples.

What is a Multi-Period Model?

A multi-period model simulates a process over time. It involves:

- States: The condition of the system at a specific time (e.g., your bank account balance, the price of a stock, the number of items in a warehouse).

- Actions/Decisions: Choices you make that change the state (e.g., depositing money, buying a stock, ordering new inventory).

- Transitions: The rules that govern how the state changes from one period to the next based on actions and random events (e.g., interest is applied, the stock price goes up or down, demand for products is met).

- Time Periods: The discrete steps (t=0, t=1, t=2, ..., t=T).

The general formula for a state transition is:

State(t+1) = f(State(t), Action(t), Randomness(t))

Common Use Cases

-

Finance:

- Portfolio Optimization: Deciding how to allocate assets over months/years to maximize wealth while managing risk.

- Retirement Planning: Simulating the growth of retirement savings over decades, including contributions, market returns, and withdrawals.

- Option Pricing: Modeling the price of a financial derivative over its lifetime.

-

Economics:

- Macroeconomic Models: Simulating GDP, inflation, and unemployment over time.

- Game Theory: Analyzing strategic interactions between firms over multiple periods (e.g., price wars).

-

Operations & Supply Chain:

- Inventory Management: Deciding how much to order each month to meet customer demand without running out or holding too much stock.

- Production Scheduling: Planning production levels over a quarter to meet demand and minimize costs.

Python Implementation: A Simple Savings Account

Let's start with the most straightforward example: modeling a savings account with monthly contributions and compound interest.

The Model

- State: The account balance.

- Action: The monthly deposit amount.

- Transition:

New Balance = (Old Balance + Deposit) * (1 + Monthly Interest Rate)

The Code

# --- Multi-Period Savings Account Model ---

# 1. Define Parameters

initial_deposit = 1000.00

monthly_contribution = 200.00

annual_interest_rate = 0.05 # 5%

num_periods = 12 # Simulate for 12 months

# Calculate monthly interest rate

monthly_rate = annual_interest_rate / 12

# 2. Initialize State

# The state is the account balance. We start with our initial deposit.

balance = initial_deposit

# 3. Loop through each time period

print(f"Starting Balance: ${balance:,.2f}")

print("-" * 30)

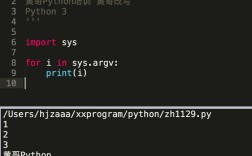

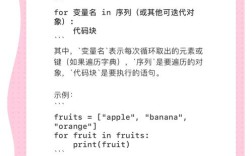

for month in range(1, num_periods + 1):

# The action is our fixed monthly contribution

action = monthly_contribution

# The transition: update the state for the new period

balance = (balance + action) * (1 + monthly_rate)

# Print the result for the current period

print(f"End of Month {month}: Balance = ${balance:,.2f}")

print("-" * 30)

print(f"Final Balance after {num_periods} months: ${balance:,.2f}")

Output

Starting Balance: $1,000.00

------------------------------

End of Month 1: Balance = $1,267.50

End of Month 2: Balance = $1,537.50

End of Month 3: Balance = $1,810.06

End of Month 4: Balance = $2,085.31

End of Month 5: Balance = $2,363.32

End of Month 6: Balance = $2,644.22

End of Month 7: Balance = $2,928.14

End of Month 8: Balance = $3,215.21

End of Month 9: Balance = $3,505.58

End of Month 10: Balance = $3,799.39

End of Month 11: Balance = $4,096.80

End of Month 12: Balance = $4,397.94

------------------------------

Final Balance after 12 months: $4,397.94More Advanced Example: Stock Price Simulation (Monte Carlo)

This is a classic use case in quantitative finance. We'll simulate a stock's price path over many periods to model its potential future value. This involves randomness.

We'll use Geometric Brownian Motion (GBM), a common model for stock prices.

The Model

- State: Stock price at time

t. - Action: None in this simple model (we are just observing).

- Transition:

Price(t+1) = Price(t) * exp( (drift - 0.5*volatility^2)*dt + volatility * sqrt(dt) * Z )drift: Expected rate of return.volatility: Standard deviation of returns.dt: Time step (e.g., 1/252 for daily steps, assuming 252 trading days in a year).Z: A random number from a standard normal distribution (representing market shocks).

The Code

import numpy as np

import matplotlib.pyplot as plt

# --- Multi-Period Stock Price Simulation ---

# 1. Define Parameters

S0 = 100.00 # Initial stock price

mu = 0.08 # Expected annual return (8%)

sigma = 0.20 # Annual volatility (20%)

T = 1.0 # Time horizon (1 year)

N = 252 # Number of time steps (trading days)

dt = T / N # Time step size (1 day)

# 2. Simulation Setup

num_simulations = 10 # Number of potential future paths to simulate

# 3. Run the Simulation

# We will store all price paths in a 2D array

price_paths = np.zeros((N + 1, num_simulations))

price_paths[0, :] = S0 # Set the initial price for all paths

# Generate random shocks for all periods and all simulations at once

# This is more efficient than looping

Z = np.random.standard_normal((N, num_simulations))

# 4. Loop through each time period to update the state (price)

for t in range(1, N + 1):

# The transition equation for Geometric Brownian Motion

price_paths[t, :] = price_paths[t-1, :] * np.exp(

(mu - 0.5 * sigma**2) * dt + sigma * np.sqrt(dt) * Z[t-1, :]

)

# 5. Visualize the Results

plt.figure(figsize=(12, 8))

plt.plot(price_paths)f"Simulated Stock Price Paths (S0={S0}, mu={mu}, sigma={sigma})")

plt.xlabel("Time Steps (Trading Days)")

plt.ylabel("Stock Price ($)")

plt.grid(True)

plt.show()

# You can also get the final price distribution

final_prices = price_paths[-1, :]

print(f"Mean Final Price: ${np.mean(final_prices):.2f}")

print(f"Standard Deviation of Final Price: ${np.std(final_prices):.2f}")

Output

This code will produce a plot showing 10 different simulated price paths for the stock over one year. Each path represents a possible future evolution of the stock price. The output will also show the mean and standard deviation of the final prices from all simulations.

Advanced Example: Inventory Management

This model introduces a cost function, which is common in operations research. The goal is to make decisions (how much to order) to minimize total cost over time.

The Model

- State: Inventory level at the start of the month.

- Action: Order quantity at the start of the month.

- Transition:

Ending Inventory = Starting Inventory + Order Quantity - Demand - Costs:

- Ordering Cost: A fixed cost per order + a cost per item.

- Holding Cost: A cost for each item held in inventory at the end of the month.

- Shortage Cost: A penalty for each unit of unmet demand.

- Objective: Minimize total cost over a 12-month period.

The Code

import numpy as np

# --- Multi-Period Inventory Management Model ---

# 1. Define Parameters

order_cost_fixed = 50.00

order_cost_per_unit = 5.00

holding_cost_per_unit = 2.00

shortage_cost_per_unit = 10.00

initial_inventory = 10

num_periods = 12

# Demand for each month (can be fixed or random)

# Let's use random demand to make it more realistic

np.random.seed(42) # for reproducibility

demand = np.random.randint(5, 20, size=num_periods)

# 2. Initialize State and Tracking

inventory = initial_inventory

total_cost = 0

# A simple policy: Order up to 40 units if inventory is below 20

reorder_point = 20

max_inventory = 40

print("Month | Start Inv | Demand | Order | End Inv | Cost")

print("----------------------------------------------------")

# 3. Loop through each time period

for month in range(num_periods):

start_inv = inventory

current_demand = demand[month]

# The Action: Decide how much to order

if start_inv < reorder_point:

order_quantity = max_inventory - start_inv

else:

order_quantity = 0

# The Transition: Update inventory

# We assume order arrives instantly

inventory = start_inv + order_quantity - current_demand

# Calculate costs for the period

ordering_cost = order_cost_fixed + (order_cost_per_unit * order_quantity)

# Inventory can't be negative in reality, so we model shortages

if inventory < 0:

holding_cost = 0

shortage_cost = shortage_cost_per_unit * abs(inventory)

inventory = 0 # Set inventory to 0 after shortage is accounted for

else:

holding_cost = holding_cost_per_unit * inventory

shortage_cost = 0

period_cost = ordering_cost + holding_cost + shortage_cost

total_cost += period_cost

# Print results for the current period

print(f"{month+1:4} | {start_inv:9} | {current_demand:6} | {order_quantity:5} | {inventory:7} | {period_cost:7.2f}")

print("----------------------------------------------------")

print(f"Total Cost over {num_periods} months: ${total_cost:,.2f}")

Output

Month | Start Inv | Demand | Order | End Inv | Cost

----------------------------------------------------

1 | 10 | 15 | 25 | 20 | 180.00

2 | 20 | 12 | 0 | 8 | 16.00

3 | 8 | 11 | 32 | 29 | 214.00

4 | 29 | 18 | 0 | 11 | 22.00

5 | 11 | 19 | 29 | 21 | 199.00

6 | 21 | 13 | 0 | 8 | 16.00

7 | 8 | 17 | 32 | 23 | 214.00

8 | 23 | 19 | 0 | 4 | 8.00

9 | 4 | 11 | 36 | 29 | 234.00

10 | 29 | 15 | 0 | 14 | 28.00

11 | 14 | 18 | 26 | 22 | 186.00

12 | 22 | 12 | 0 | 10 | 20.00

----------------------------------------------------

Total Cost over 12 months: $1,637.00Key Libraries for Multi-Period Modeling

- NumPy: Essential for numerical operations, especially when dealing with arrays of data (like the stock price simulation).

- Pandas: Excellent for handling time-series data. You can easily create a DataFrame to store the state, actions, and costs for each period.

- Matplotlib / Seaborn: Crucial for visualizing the results of your simulations over time.

- SciPy: Provides advanced optimization algorithms (e.g.,

scipy.optimize) which are used to find the best actions in complex models. - SimPy: A powerful discrete-event simulation library that can be used to model more complex systems where events happen at irregular intervals.