Of course! The chainladder library is a powerful and specialized Python package for actuarial loss reserving. Its primary purpose is to estimate the ultimate amount of insurance claims that will be paid for a group of insurance policies, a process known as "loss reserving" or "IBNR (Incurred But Not Reported) reserving."

Here’s a comprehensive guide covering what it is, why it's used, and how to use it with code examples.

What is Chainladder and What Problem Does it Solve?

Imagine an insurance company. Policies are sold, and claims are filed over time. However, there's a delay between when a claim occurs and when it's fully reported and settled.

- Accident Year: The year a claim-causing event (like a car accident) happened.

- Development Lag: The number of years that have passed since the accident year.

- Cumulative Losses: The total amount of money paid for claims up to a certain development lag.

The core problem is: Given the cumulative losses we have paid so far for past accident years, how much do we expect to pay in the future for the current (and future) accident years?

chainladder provides a framework to apply established actuarial methods to this data. It's built on pandas and scikit-learn, making it familiar to data scientists.

Key Concepts in Chainladder

Before diving into code, let's understand the main components:

- Triangle: This is the fundamental data structure in

chainladder. It's a specializedpandas.DataFramethat represents the cumulative loss data. The rows typically represent the accident year, and the columns represent the development lag (e.g., 12 months, 24 months, etc.). The data is "triangular" because for the most recent accident year, we only have data for the first few lags.

| Accident Year | 12 months | 24 months | 36 months | 48 months | 60 months |

|---|---|---|---|---|---|

| 2025 | 1101 | 2177 | 3365 | 4125 | 4512 |

| 2025 | 1170 | 2389 | 3588 | 4235 | * |

| 2025 | 1265 | 2667 | 3982 | * | * |

| 2025 | 1420 | 2998 | * | * | * |

| 2025 | 1540 | * | * | * | * |

-

Development Method: These are the core algorithms used to project the lower-right triangle (the values) to a complete triangle. The library comes with many standard methods:

Chainladder: The basic, volume-weighted average method.Bornhuetter-Ferguson: A more advanced method that combines past loss experience with an "expected loss ratio" (often from pricing).Mack: A stochastic method that provides not just a point estimate but also a prediction error (standard deviation) for the ultimate loss.Clark-L: A method that uses generalized linear models (GLMs) for a more robust approach.

-

Ultimate Loss: The final, estimated total loss for each accident year, after all development has occurred.

-

IBNR (Incurred But Not Reported): The difference between the Ultimate Loss and the Cumulative Loss reported so far. This is the amount the company still needs to set aside for future payments.

Installation

First, you need to install the library. It's highly recommended to install its optional dependencies as well.

pip install chainladder pip install chainladder-extras # For more advanced models and functionality

A Practical Step-by-Step Example

Let's walk through a complete workflow: loading data, running a model, and interpreting the results.

Step 1: Load and Prepare Data

The chainladder library comes with some sample datasets. We'll use the famous RAA dataset, which is a classic triangle used for teaching reserving.

import chainladder as cl

import pandas as pd

# Load the sample RAA dataset

# It's already in a triangle format

raa = cl.load_sample('RAA')

# Display the raw triangle

print("--- Raw Cumulative Loss Triangle ---")

print(raa)

print("\n")

# You can easily access the underlying pandas DataFrame

print(raa.valuation_date)

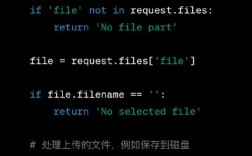

Step 2: Apply a Development Model

This is where the magic happens. We will use the Chainladder method to project the ultimate losses. The fit_transform method does both: it fits the model to the data and transforms the triangle into a completed one with projections.

# Apply the basic Chainladder development method

# This will calculate the development factors and project the ultimate losses

cl_model = cl.Chainladder().fit_transform(raa)

# The result is a new triangle with additional attributes

print("--- Chainladder Output Triangle ---")

print(cl_model)

print("\n")

# You can see the calculated development factors

print("--- Calculated Development Factors ---")

print(cl_model.ldf_)

print("\n")

# You can see the cumulative development factors (CDF)

print("--- Cumulative Development Factors (CDF) ---")

print(cl_model.cdf_)

Step 3: Extract and Interpret the Results

The output triangle (cl_model) is packed with useful information. The most important one is the ultimate loss estimate.

# The ultimate loss estimate is in the 'ultimate' attribute

ultimate_losses = cl_model ultimate

print("--- Estimated Ultimate Losses by Accident Year ---")

print(ultimate_losses)

print("\n")

# To get a simple pandas Series of ultimate losses

ultimate_series = ultimate_losses.latest_diagonal

print(ultimate_series)

Step 4: Calculate Key Reserve Metrics

Now we can easily calculate the IBNR and the total reserve the company needs to hold.

# The latest diagonal of the *original* triangle is the current cumulative loss

current_cumulative = raa.latest_diagonal

# IBNR is Ultimate - Cumulative

ibnr = ultimate_losses.latest_diagonal - current_cumulative

print("--- IBNR Reserves by Accident Year ---")

print(ibnr)

print("\n")

# Total Reserve is the sum of all IBNR

total_reserve = ibnr.sum()

print(f"Total Loss Reserve to be held: ${total_reserve:,.2f}")

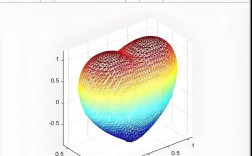

Step 5: Visualize the Results

Visualization is crucial for understanding the development patterns.

import matplotlib.pyplot as plt # Plot the original data and the ultimate projections # The `plot` method is very convenient cl_model.plot().show() # You can also plot the development factors cl_model.ldf_.plot().show() # A more detailed plot showing the original data, the projected development, # and the ultimate estimate. cl_model.plot_development().show()

Comparison with Another Method (Bornhuetter-Ferguson)

The Chainladder method is purely based on past experience. The Bornhuetter-Ferguson method is often preferred in practice because it incorporates an "expected loss ratio," which acts as a stabilizer, especially for recent accident years with little data.

# Define an expected loss ratio (e.g., 80% of earned premium)

# The RAA dataset has an 'EarnedPrem' column

elr = 0.80

# Apply the Bornhuetter-Ferguson method

bf_model = cl BornhuetterFerguson().fit_transform(raa, sample_weight=elr * raa['EarnedPrem'])

# Compare the results

cl_ultimate = cl_model ultimate.latest_diagonal

bf_ultimate = bf_model ultimate.latest_diagonal

comparison = pd.DataFrame({

'Chainladder Ultimate': cl_ultimate,

'Bornhuetter-Ferguson Ultimate': bf_ultimate,

'Difference': bf_ultimate - cl_ultimate

})

print("--- Comparison of Ultimate Loss Estimates ---")

print(comparison)

You'll notice that the Bornhuetter-Ferguson estimates are often lower for the most recent years. This is because it "shrinks" the purely-experience-based estimates towards the more stable expected loss ratio.

Advanced Features: Stochastic Methods and Mack's Model

For a more complete analysis, actuaries need to understand the uncertainty of their estimates. chainladder supports stochastic models, most famously Mack's Model.

# Mack's model provides a stochastic chainladder

mack_model = cl.MackChainladder().fit_transform(raa)

# The output now includes a full prediction distribution

mack_full_triangle = mack_model.full_triangle_

# The ultimate loss is now a distribution

mack_ultimate = mack_model ultimate

# You can get the mean and standard deviation of the ultimate

ultimate_mean = mack_ultimate.latest_diagonal

ultimate_std = mack_model.full_std_.latest_diagonal

mack_summary = pd.DataFrame({

'Mean Ultimate': ultimate_mean,

'Std Dev': ultimate_std,

'CV (%)': (ultimate_std / ultimate_mean * 100).round(2)

})

print("--- Mack's Model: Ultimate Loss Estimates with Uncertainty ---")

print(mack_summary)

This allows you to say something like: "We estimate the ultimate loss for the 2025 accident year to be $1.5M with a standard deviation of $200,000," which is far more informative for financial planning and risk management.

Summary

| Task | Code | Key Concept |

|---|---|---|

| Load Data | cl.load_sample('RAA') |

Triangle object |

| Apply Model | cl.Chainladder().fit_transform(data) |

Development Method |

| Get Ultimate | model.ultimate.latest_diagonal |

Final Loss Estimate |

| Get IBNR | model.ibnr.latest_diagonal |

Reserve to be Held |

| Plot | model.plot() |

Visualization |

| Stochastic | cl.MackChainladder() |

Mack's Model for Uncertainty |

The chainladder library is an essential tool for anyone working with insurance or reinsurance data. It provides a robust, well-tested, and user-friendly interface to perform complex actuarial calculations in a Pythonic way.